After carefully reviewing the economic indicators of our country, we decided that the business model of broker is best to adapt to the Panamanian economy. A part of our research was based on the paper: “Do Some Business Models Perform Better than others? A Study of the 1000 Largest US Firms” by Peter Weill, Thomas W. Malone, Victoria T. D’Urso, George Herman and Stephanie Woerner (MIT).

Defining a broker, this business model represents the company responsible for matching sellers with potential buyers, they have no ownership over the asset sold but they receive a commission from the seller, the buyer or both. This model is very common in real estate, insurance and stock market. Some known examples of this model are the companies: eBay, Priceline, Century 21 and Valassis.

Synthetic biology is well-matched to perform according to this model in Panama as the country is very competitive in regional distribution and this area has not been exploited yet neither in the country nor in Latin America.

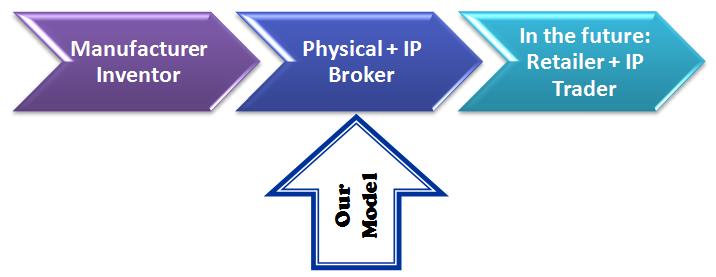

Many companies in the world, such as General Electric, operate with more than a business model so we took this as a reference on what steps to take in the future, as far as expanding the market.

Our medium-term model includes an expansion of our operations to the vast majority of the region of Central America and eventually the entire Latin American territory. Thus, we are not depending entirely on the Panamanian economy so we won’t be vulnerable to a single jurisdiction.

In the paper studied, in order to develop their research they followed the lead of Ketchen et al who identified a table of 45 measures of performance in 6 categories: Sales, Equity and Investment, Assets, Margin and Profit and Market share. The result was a performance assessment using two metrics in each of three classes of performance: operating income and Economic Value Added (as measures of profit), return on invested capital (ROIC) and return on assets (as a measure of rates of return and efficiency), and market capitalization and Tobin’s Q (as a measure of market value). All these measures have been used in many studies of financial performance.

From this study it was concluded that the business models Broker and Landlord have operating revenues and market capitalization significantly higher than the models for Creator and Distributor as well as the models based on non-physical assets (intangible, human and financial) over those based on physical assets. This result is translated as follows: selling the right to use assets is concluded to be more profitable and more highly valued by the market than selling ownership of assets.

A proof that this model is feasible in synthetic biology, we studied the case of a successful company called ‘Amyris’, which is dedicated to offer a wide range of petroleum products. For our specific situation, our country is non-industrial and doesn’t have an established investigation center so we perceive that using the model of broker is the best option to take.

"

"