Team:UTPreneur/Executive Summary

From 2012e.igem.org

(Created page with "<div align="center"> '''EXECUTIVE SUMMARY'''<br><br> <div align="justify"> We aim to develop a business model working as Physical and IP Brokers. Our model is based in the idea o...")

Newer edit →

Revision as of 04:16, 4 September 2012

EXECUTIVE SUMMARY

We aim to develop a business model working as Physical and IP Brokers. Our model is based in the idea of being able to connect the projects developed in the iGEM competition to real life applications. We want to provide solutions to different companies through our services as IP or Physical Brokers performing as consultants for SynBio products.

A broker is an individual that arranges transactions and brings together a buyer and a seller, and gets a commission when the deal is executed. It’s an independent agent that may represent either the seller (most of the time) or the buyer but not both at the same time.

To offer our service, we will contact the I+R Department´s Manager and thought them into us, providing solution for problems in fields such as food and energy, manufacturing, environment, health and medicine and other applications following the lead of iGEM's College Competition tracks. The service is valuable because we deliver biobricks, consulting and training. We will reach, acquire and keep customers through internet, direct contact, follow up, campaign, attractors and marketing.

Brokers can furnish considerable market information regarding prices, products and market conditions. They know their market; have already established relations with prospective accounts and have the tools and resources to reach the largest possible base of buyers.

The revenue will be generated by trading fees (commissions), retailing, consulting, following up + training + maintenance. And the profit margin depends on saving because there is no price for this service on the actual national market.

Justification of our business model

Panama's economy is one of the most stable in America. The main activities include financial services, tourism and logistics, which represent 75% of GDP. From 2003 to 2009 the GDP doubled, fueled by high foreign and domestic investment, tourism and logistics industry. The World Bank, IMF and the UN have qualified Panama as the highest per capita income in Central America, also as the largest exporter and importer at the regional level according to ECLAC. The GDP has more than twenty years in a row of sustained growth. The country is classified in the category of investment grade by credit rating companies: Standard and Poors, Moody's and Fitch Ratings. According to the lists of the International Monetary Fund, World Bank and CIA World Factbook, Panama, with an estimated growth of 5%, is the number 89 as its GDP in recent years.

Panama depends on its conglomerate of transportation and logistics services-oriented world trade, whose epicenter is the Panama Canal. About the Panama Canal coalesce container transshipment ports, trade zones, rail hub and the largest airline hub in Latin America. It also has the largest financial center in Latin America. The services offered are very well connected with the world market and interconnected. These services account for about three quarters of its GDP.

Panama has great facility creating companies, and since 2007 has initiated a policy of creating businesses that seek to promote the rapid creation of companies, both domestic and foreign capital, creating a business climate by utilizing appropriate technology, based on greater public confidence.

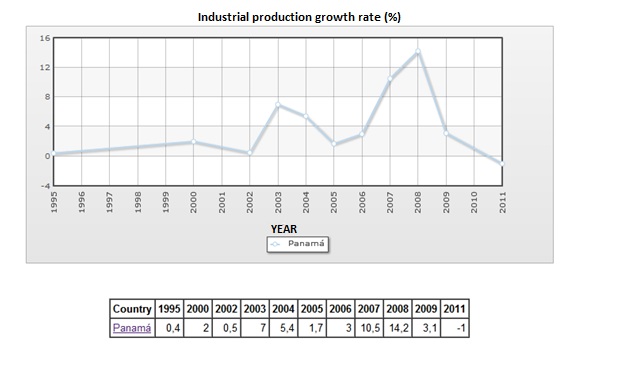

Is important to know, industrial growth is very poor in Panama, and as we see in the chart below, the growth rate of industrial production ended in -1% for 2011, one of the most important indicators that we will take into consideration in our business model, because it gives us the idea that this Central American country is not competitive for the production or manufacturer sector (as mentioned earlier), but instead is one of the most competitive for logistical purposes, such as distribution and transportation of all kind of merchandise.

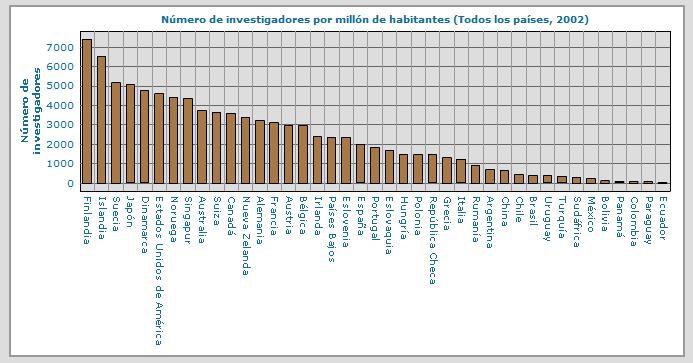

Also Panama is among the countries with fewer researchers per million inhabitants. (Panama´s population: 3.5 million).

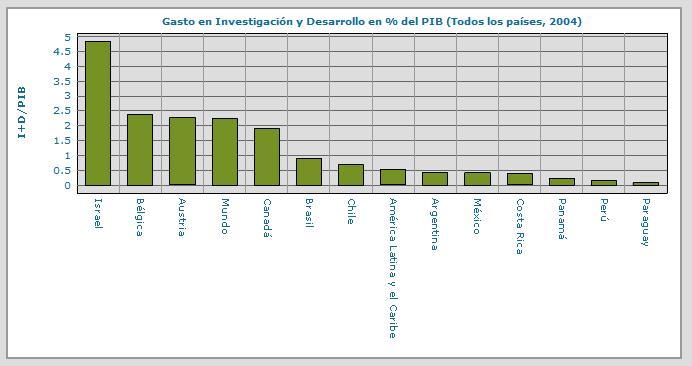

But it is important to mention that one of the most influential factors of the lack of development in research is because there is not enough capital to do so. As shown in figure Panama is the third country with less spending on research and development of GDP by 2004.

This graph represents the same as above, except that compared to countries with high research and development as the U.S. and Germany, with Latin America, and finally Panama.

After carefully reviewing the economic indicators of our country, we decided that the business model of broker is best to adapt to the Panamanian economy. Defining a broker, this business model represents the company responsible for matching sellers with potential buyers, they have no ownership over the asset sold but they receive a commission from the seller, the buyer or both.

Also we research in a paper called “Do Some Business Models Perform Better than others? “A Study of the 1000 Largest US Firms”, by Peter Weill, et al. (MIT).

In the paper studied, we identified a table of 45 measures of performance in 6 categories: Sales, Equity and Investment, Assets, Margin and Profit and Market share. The result was a performance assessment using two metrics in each of three classes of performance: operating income and Economic Value Added (as measures of profit), return on invested capital (ROIC) and return on assets (as a measure of rates of return and efficiency), and market capitalization and Tobin’s Q (as a measure of market value). All these measures have been used in many studies of financial performance.

From this study it was concluded that the business models Broker and Landlord have operating revenues and market capitalization significantly higher than the models for Creator and Distributor as well as the models based on non-physical assets (intangible, human and financial) over those based on physical assets. This result is translated as follows: selling the right to use assets is concluded to be more profitable and more highly valued by the market than selling ownership of assets.

Future plans, if our university takes place in our business

Our model will suggest a strategic alliance with an institution because it’s difficult to find the funds to cover the initials expenses; also the advantage of having an active relationship provides the company with a sense of stability.

In our case as a company created by students of the Technological University of Panama, the institution gives us support to start our business; they provide us the chance to consult with experts in each field who work in the university such as economists, engineers and legal advice that would help us to settle in the market.

This advice may take up to a period of 36 months; our university checks periodically how the business is performing and obviously makes the corrections for our business to be completely viable.

As mentioned previously the help of the university would also include the implementation of a comprehensive business plan and according to the needs presented.

Currently is under discussion the possibility that the university changes a business in to a "spin-off" as they currently do not charge any commission or percentage to the companies that approach them the following steps:

• Entrepreneur gets the funds to carry out the project.

• Incubation firm contract between the university and the Entrepreneur.

• Schedule of Activities for entrepreneur (training, management and linking).

• Monitoring and control activities.

• Marketing product or service.

• Sustainability over time.

"

"